Richmond lawmakers submit bills to help high school students, businesses

2/1/2018, 8:20 p.m.

By Deanna Davison

Capital News Service

Juniors and seniors in Richmond Public Schools would receive paid apprenticeships and training with local businesses, and participating employers would get tax credits from the state, under legislation filed by Richmond lawmakers.

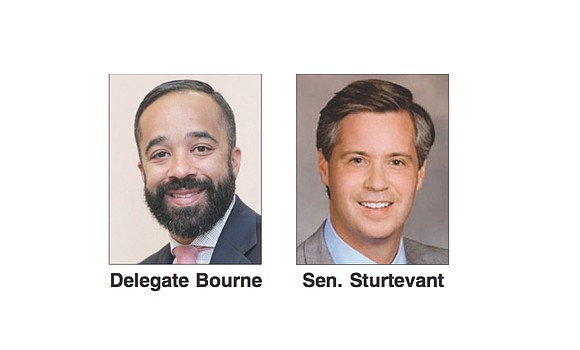

Democratic Delegate Jeffrey Bourne and Republican Sen. Glen Sturtevant, who both represent parts of the city in the General Assembly, want to establish a pilot program for the 2018-19 or 2019-20 academic year.

Under the program, up to 25 Richmond students would receive “competitive compensation” while being trained in high-demand fields.

Delegate Bourne and Sen. Sturtevant say it is important to help students who do not pursue traditional college degrees prepare for the workforce.

“This pilot program will provide a great opportunity for bright and hard-working students to get hands-on experience,” Sen. Sturtevant said.

Participating local businesses would receive a $2,500 tax credit per student per semester. Student compensation would equal “no less than the value” of that credit. The total tax credits awarded by the state could not exceed $125,000 a year, according to their bills.

Delegate Bourne and Sen. Sturtevant previously served together on the Richmond School Board for four years.

The lawmakers have submitted companion bills to create the apprenticeship program. Sen. Sturtevant has introduced SB 937 in the Senate, while Delegate Bourne is the patron of HB 1575 in the House of Delegates. Both measures are awaiting committee hearings.