Gen Z’er takes advantage of once-low interest rates to purchase first home

Darlene M. Johnson | 1/25/2024, 6 p.m.

In 2021, Raven Moseley needed a place to stay, but she could not afford an apartment that she felt comfortable in without splitting the bill with a roommate. Plus, she could not find a suitable roommate.

That is when her mother gave her the idea to buy a home.

The lower interest rates in wake of the COVID-19 pandemic helped Ms. Moseley, now 24, in her home-buying search, but it also made the market more competitive, she said.

Homes were going fast and people constantly were outbidding her. Just when she was at the point of giving up on her dream of buying a home, her third offer was accepted.

Once she closed on her home, Ms. Mosely joined the nearly 30% of 25-year-old Generation Z’ers who owned their homes in 2022, according to an analysis by Redfin, the Seattle-based residential real estate brokerage and mortgage origination company.

The percentage is slightly lower than that of baby boomers who owned homes at age 25 (32%), but slightly higher than homeownership rates for millennials (28%) and Generation X (27%) at the same age. Members of Generation Z were born after 1996.

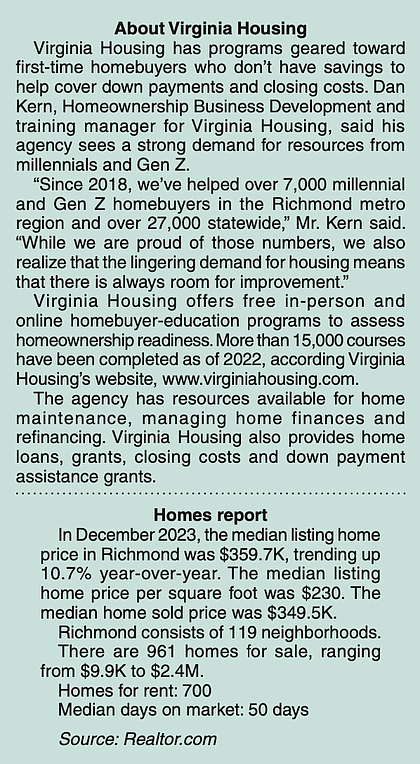

“The number of millennial and Gen Z homebuyers has been steadily increasing for years,” said Dan Kern, Homeownership Business Development and training manager for Virginia Housing. “However, the number of buyers peaked in 2020-2021 and has declined since then due to the lack of housing inventory and the sharp increase in interest rates that began in March of 2022.”

Ms. Moseley said she believes the home was destined for her as it had been on the market since 2021 before she bought it for $192,000 in 2022. To cover closing costs and a down payment on the three-bedroom single family house, Ms. Moseley used savings she had built up since March 2020, along with first-time homebuyer loans, some of her 401(k) and help from family, she said.

Ms. Moseley said she wouldn’t have been able to afford her house at the current interest rates at an average of 7%. She is grateful for the lower interest rates at 3.5% that allowed her to buy her Church Hill home.

“I never rented anything in my life,” Ms. Moseley said. “This is my first place. This was not on my bingo card. She added that had she waited to purchase her home two to three weeks after she closed on it, “I wouldn’t have been able to even afford my house.”

Although it is hard to predict what interest rates will be in the future, housing analysts say the current 7% interest rate is not unusual.

A recession could bring rates back down, but it seems unlikely that they would return to 3% or 4% anytime soon, Mr. Kern said.

“Other than a sharp upward spike in rates during the late 1970s and early ’80s, rates for a 30-year, fixed-rate mortgage have traditionally been in the 6% to 7% range for decades” Mr. Kern said. “After the Great Recession in 2008, we saw rates drop into the 3% and 4% range and stay there for 14 years. Everyone got used to that being the ‘norm’ when it was truly abnormal.”

Gen Z’ers who are not yet homeowners— and who did not take advantage of the lower interest rates from the pandemic— face many obstacles. The biggest issues involve finances, Mr. Kern said. Many Gen Z’ers and millennials are carrying a much higher amount of student loan debt than previous generations, and that makes it harder to qualify for mortgages and even rentals in today’s housing market, he said.

Previous generations also were able to buy homes for two to three times their annual income despite interest rates being in the double digits, making the mortgage payments manageable, Mr. Kern said.

“Because household incomes have not kept up with the rapid appreciation of home values, millennial and Gen Z buyers might be looking at regional housing prices that exceed eight to 10 times their annual salary or 50% to 75% of monthly net income,” Mr. Kern said.

To mitigate this, more housing inventory is needed to slow the rate of appreciation, he said. Zoning changes that allow for more density per acre and smaller square footage home configurations — such as condominiums and townhomes — also could help.

“Taking advantage of new building technologies that can reduce the cost of construction should also continue to be a top priority,” Mr. Kern said.