Mayor proposes tax hikes to fund improvements

Jeremy M. Lazarus | 7/1/2016, 6:46 a.m.

Richmond has monster needs.

Most of its schools are decaying, its streets are falling apart, its parks and public buildings need renovation — but it has maxed out its credit card and can’t afford to borrow any more money.

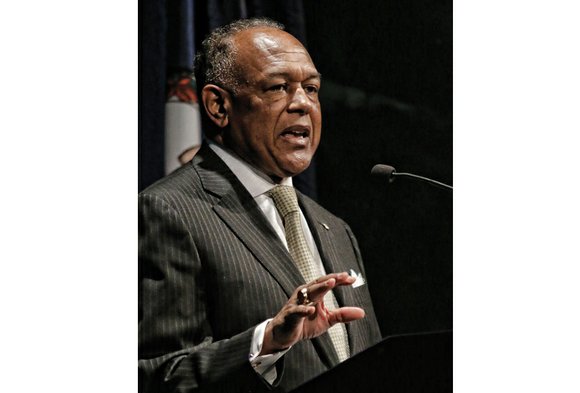

According to Mayor Dwight C. Jones, there is only one way to fix the problem: Raise taxes so the city can afford additional borrowing.

It’s a reversal of the mantra Mayor Jones arrived in office with — that Richmond “cannot tax its way” to prosperity.

Under a plan unveiled Monday, the mayor called for creating the city’s first cigarette tax and boosting city taxes on real estate, cars and personal property, admission tickets, car licenses and restaurant meals in the next budget.

With six months left before he leaves office, and with multiple candidates jockeying to replace him and fill seats on Richmond City Council, it is unclear whether his plan will go anywhere.

After all, he presented his final budget this year, and it will be the next mayor who will be presenting the 2018 budget. Nor is it clear that the nine City Council members will buy into the plan — including new members who will fill at least three seats incumbents are leaving.

Council President Michelle Mosby, a candidate for mayor, said she welcomes the proposal, but needs more information before taking a position.

Still, the proposal makes clear the size of the challenge that Richmond is facing.

According to the plan, Richmond would need to borrow $1.5 billion in the next 10 years to bring its buildings and infrastructure up to snuff.

But that money is out of reach, according to the plan.

“Serious and even chronic budget challenges have resulted from tax reductions followed by an economic recession,” according to information in the plan. “The city has operated for almost a decade with no revenue growth” — and certainly insufficient funds to address numerous school and city needs.

The plan the mayor unveiled would cover only about $583 million of those needs, or just about one-third.

Called the “Triple-Action Investment Plan,” the proposal created by the city’s financial adviser, Davenport & Co., provides a way for the city to boost its borrowing — by linking to tax increases.

Under the plan if approved by City Council, the city would raise its self-imposed debt ceiling from 10 percent of the budget to 12 percent — allowing the city to borrow more than $580 million in additional funds during the next 10 years.

That includes $234 million to improve school buildings and $350 million for city projects during the 10 years.

School officials said that kind of money would enable them to address “capacity needs,” which are becoming critical as the school-age population grows in South Side.

According to Assistant School Superintendent Tommy Kranz, that kind of money would ensure RPS could replace Greene Elementary School and Elkhardt-Thompson Middle School with new, larger buildings, which he considers a necessity to handle growth south of the James River.

Under the investment plan, council would need to adopt a strategic funding plan that would prioritize all city capital needs and determine the amount of new revenue required to cover costs and support the initial borrowing allowed by an expanded debt capacity.

The plan also recommends creating measurable ways to track spending so the public can easily learn how the money is being spent.

The linchpin to the whole plan would be tax increases that would determine how much additional money could be borrowed.

According to the plan, the menu of proposed tax increases would raise an extra estimated $27 million a year in the first two years if City Council approved them all in the next budget. That would increase to $40 million a year in 2020 and thereafter.

The menu includes imposing a 30-cent tax on a pack of cigarettes to raise an estimated $5 million a year.

The plan also would raise real estate taxes by 5 cents, from $1.20 per $100 of assessed value to $1.25 in 2018. That would raise an extra $9.5 million a year for the city. In 2020, the real estate tax would be increased another 5 cents, boosting tax collections by another $9.5 million a year.

The proposal also would boost the city’s motor vehicle tax from $30 to $33 a year, under the plan, to raise an additional $393,000. Separately, the admissions tax on tickets for entertainment events, now 7 percent, could be increased to 8 percent in 2018 to raise an extra $415,000 a year, and to 9 percent in 2020 to gain another $415,000 a year.

The tax on personal property such as cars and trucks, now $3.70 per $100 of assessed value, is proposed to jump to $4.07 per $100 in 2018 to raise an extra $3.2 million. Under the plan, it would rise again to $4.41 in 2020, raising an additional $3.2 million.

Finally, the menu of proposed tax increases would hike the city’s meals tax from 6 percent to 7.5 percent in 2018 to raise an additional $8.25 million a year.

On top of those increases, the plan recommends that the council steer 20 percent of annual revenue growth from real estate taxes to debt service. That would raise about $1.5 million a year to help pay back the new borrowing.

If all goes right, Richmond could pay for the new debt and create a $132 million capital reserve fund that Davenport & Co. stated would be needed to enhance the city’s fiscal position.

However, this is unlikely to be an easy sell in a city where one in four people lives in poverty.

Mayor Jones is undaunted, despite his lame duck status.

“This is a realistic approach that provides a 10-year program to move us forward,” he said. “This is a well thought out plan that will require discipline, but that will make us a better city in the long run.”