City Hall offers some reforms on tax collections

Jeremy M. Lazarus | 1/18/2024, 6 p.m.

Amid the uproar over meals-tax collections, City Hall is rolling out a multiple-step plan in a bid to ease complaints.

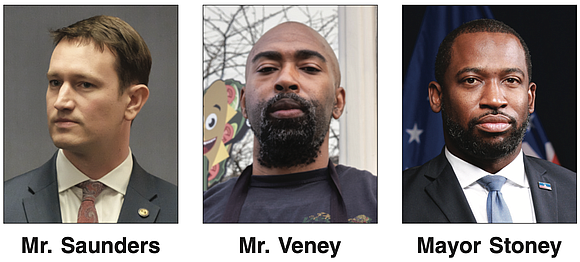

Responding to City Council members who have gotten an earful from businesses, J.E. Lincoln Saunders, the city’s chief administrative officer, offered up a series of reforms. His plan calls for reducing the first penalties on businesses and individuals who are late in paying taxes and providing a convenient no-fee online option for paying taxes going forward.

That plan might not go far enough. First District Council member Andreas D. Addison said Tuesday that the plan needs to have a “retroactive component” to address the complaints that businesses have raised about huge tax bills resulting from late payments or other problems for which they say were never notified.

Mr. Addison said he is advocating for a new amnesty program that would eliminate the penalties, interest and fees that were assessed in 2020 and 2021, when routine notices of late payments were halted.

Richmond Jazz and Music Festival reference in Free Press’ meals-tax story is misleading

There is a gratuitous and incorrect paragraph in a front-page story (January 4-6 edition) about the local meals tax collection issue.

In the story, Free Press reporter Jeremy Lazarus reaches back to 2018 and alleges by innuendo that Ken Johnson received preferential treatment by the city of Richmond.

In 2018 the issue related to admission taxes that Mr. Johnson’s company allegedly owed the city for a jazz festival that Johnson Inc. organized and promoted. It was found that no taxes were owed because the type of event and the venue were not subject to tax.

The story asserts that admissions tax — not meals tax — for an event organized and promoted by Mr. Johnson’s business, Johnson Inc., was “wiped out” by a city administrator who no longer works for the city. The reporting implies in the story that Mr. Johnson’s political relationship with Mayor Stoney played a significant role in that decision.

As I understand it, the admissions tax that Mr. Lazarus references was never applicable to the jazz festival even. It was assessed in error in 2018, and was rescinded because it was an error.

To reference the jazz festival situation in this reporting was a reach too far and should never have been a part of this meals tax controversy story. It implies cronyism and wrongdoing.

That was not the case. The Free Press regrets the error.

JEAN PATTERSON BOONE

Publisher

The city stopping issuing such notices after the pandemic began in March 2020 and did not resume them until June 2022, leaving many businesses in the dark about penalties and interest assessed for late payments.

The fresh focus on the Finance Department and its collection procedures began with a social media post from Samuel Veney, co-owner of the Philly Vegan takeout sandwich shop in South Side. Mr. Veney drew wide attention with the post that blasted the city for hitting him with a $37,000 bill for uncollected meal taxes.

Mr. Veney claimed that a Finance Department employee instructed him not to collect the meals tax when the shop was licensed to operate in June 2021. He said the shop followed that instruction until March 2022 when a department tax auditor told him the direction he got was wrong.

He is not alone. Richbrau Brewery also claimed he received a bill for more than $50,000 after initially being instructed by the Finance Department not to collect the tax on draft beer.

Public criticism of the city’s processes only increased with an open letter on social media from Kevin Grubbs, owner of the Latitude Seafood Co. at Stoney Point.

That letter noted that an $800 late fee on meals taxes had grown to a bill of more than $68,000 over two years. He claims the department never notified him about the initial late fee.

The Virginia Restaurant Association later noted that at least 25 members have reported other horror stories, attracting the attention of the General Assembly, with legislation being introduced to overhaul local collection practices.

The meals-tax issue presents a problem for Mayor Levar M. Stoney and his administration because it involves the alleged mistreatment of small businesses that he has declared the backbone of growth and jobs.

In his Jan. 11 letter to the City Council, Mr. Saunders said the main solution will come from implementing new taxpayer payment and account software called RVA-Pay, which will make it easier for taxpayers look up their accounts, balances and payments.

While the implementation of RVAPay for most taxes is still months away, Mr. Saunders wrote that he has authorized other steps.

One of the biggest, if the Council approves it, would be to change the practice of applying new fees to delinquent bills first. He promised to submit an ordinance to the Council that would require payments to be applied to a current bill first and then to delinquent amounts.