More states are teaching financial literacy

Associated Press | 10/12/2023, 6 p.m.

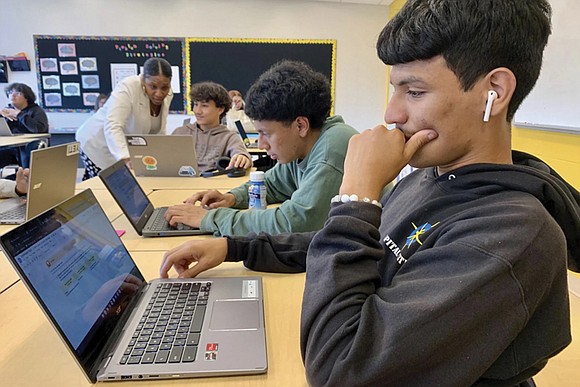

WASHINGTON - Inside a high school classroom, Bryan Martinez jots down several purchases that would require a short-term savings plan: shoes, phone, headphones, clothes, and food.

His medium-term financial goals take a little more thought, but he settles on a car — he doesn’t have one yet — and vacations. Peering way into his future, the 18-year-old also imagines saving money to buy a house, start his own business, retire and perhaps provide any children with a college fund.

Martinez’s friend next to him writes a different long-term goal: Buy a private jet.

“You have to be a millionaire to save up for that,” Bryan said with a chuckle.

Math is hard — even for teachers. What if they conquered their math anxiety?

Call it a reality check or an introduction to a critical life skill, this exercise occurred in a course called advanced algebra with financial applications. The elective math class has been a mainstay in Capital City Public Charter School’s offerings for more than a decade, giving students a foundation in money management while they hone math skills. Conversations about credit, investments, and loans, for instance, intersect with lessons on compound interest, matrices, and exponential equations.

The Washington, D.C., charter school may be a front-runner in providing financial education, but in recent years, many others have followed suit. Since 2020, nine U.S. states have adopted laws or policies requiring personal finance education before students graduate from high school, bringing the total number to 30 states, according to the Council for Economic Education.

The surge comes as educators are scrambling to bolster students’ math skills, which plummeted during the pandemic and haven’t fully recovered. At the same time, a general dislike for math remains an obstacle among young people.

In 2020, the NAACP issued a resolution calling for more financial literacy programs in K-12 schools.

The equity consideration has been a driving force behind the financial literacy course at Capital City Public Charter School, which serves a student body that is 64% Latino and 25% Black.

“It’s an empowering course,” said Laina Cox, head of the school. “I think it gives our young people the language that they need and the voice when they’re in certain rooms and at certain tables.”