Richmonders tend to procrastinate when filing taxes, study shows

George Copeland Jr. | 3/28/2024, 6 p.m.

With Tax Day less than a month away, Richmonders are likely to be among residents in more than 100 cities throughout the country who wait until the last minute to file their taxes.

A recent study by ChamberofCommerce.org, based on sources that include the U.S. Census Bureau, the Internal Revenue Service and the Pew Research Center, found that Richmond residents are among the highest number of procrastinators when it comes to tax filing.

Their ranking? Tenth in the country.

Among the 170 cities with a population of 150,000 or more that were researched for the study, Richmond had 2,790 online searches related to filing taxes late per 100,000 residents.

For professionals who assist clients and prepare taxes, the study’s findings weren’t too surprising.

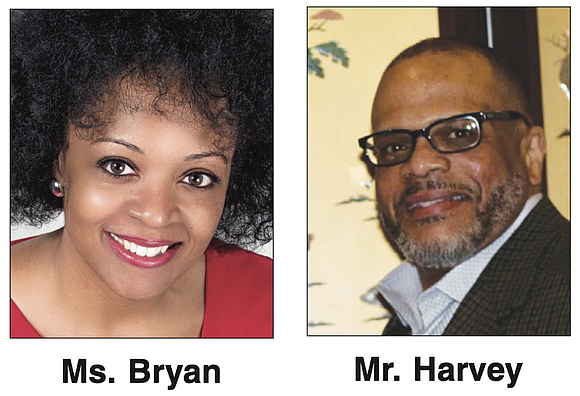

“Yes, this has some truth,” said Michael L. Harvey, founder and CEO of MLH Assets Management, when asked for his thoughts on the study. “I have several clients who are procras- tinators when it comes to filing their income taxes.”

Mr. Harvey noted that about 50 to 75 of clients he works with each year file their taxes late. However, he said this propensity has not negatively affected his firm’s work flow.

JB Bryan of the JB Bryan Financial Group, by contrast, hasn’t seen such issues as her firm helps clients prepare for their taxes throughout the year rather than at specific periods or months. She also acknowledged that there are those with more complicated returns that will need more dedicated assistance and preparation with their taxes.

However, Ms. Bryan still stressed the need for the average person to go through the filing process in a timely fashion, warning that failing to do so can incur unnecessary penalties and risk losing potential benefits from tax returns.

“If a person is a procrastinator in their tax preparation or in the presentation of it or the data entry of it or in the filing of it, then it is most likely they have overpaid in their taxes,” Ms. Bryan said. “They made a lot of mistakes and they’ve missed out on a lot of tax filing, tax planning and tax strategy opportunities that are there for them.”

When it came to why Americans procrastinate when it’s time to file taxes, 51% surveyed by ChamberofCommerce.org said it was because they find the process too complicated and stressful.

By contrast, 47% cited a natural tendency to procrastinate as the cause, and 42% said the filing process is too time-consuming, leading them to put it off until the last minute.

However, as Ms. Bryan noted, this fear and hesitation leaves tax filers seeking unneeded, costly tax assistance services, rather than taking advantage of the many free options available to those in need when tax season arrives.

Her best advice to clients and other is to “take your time and do it.”

The Tax Day deadline for submissions is on Monday, April 15. People who require help filing securely and with no additional cost or for other information can find resources at www.irs.gov